Accruals and Prepayments Journal Entries

Rent and rates 7100 Monthly rent prepayment 200 Leave clear Prepayments 1120 Rent prepayment reversal 200 Leave clear Youve now recorded the monthly prepayment. Expenses paid cash A liability-expense b.

Understand How To Enter Accruals Prepayments Transactions Using The Double Entry System Youtube

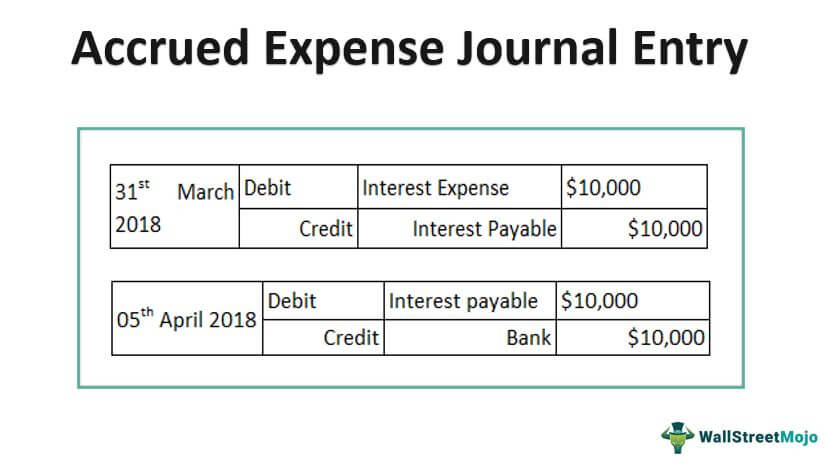

Accrued Expense and Prepayment What is Accrued Expense.

. December 20th 2019 Same day December 31st 2019 End of period adjustment January. In most cases it is also. To record the monthly prepayment journal.

Adjusting entries are changes to journal entries youve already recorded. By April 22 2021 0. The second step is all about amortizing the prepaid expense account for the consumption over time.

A prepayment is when you pay an invoice or make a payment for more than one period in advance but want to show this as a monthly expense on your profit and loss. We ignore expense classification in this example to simplify the. Accruals and Prepayments Journal Entries The basic principle behind accrual accounting is to record revenues and expenses regardless of payment.

Show all entries including the journal entry for prepaid expenses on these dates. For example you may pay 12000 for rent in January to. Prepaid Rent Income Liability 10000.

The entries to adjust a prepayment credit would be a credit to the Prepayment account and a debit to Deferred Revenue. Solution to recording accrued expenditure Solution The total expense charged to the income statement in respect of insurance should be 24000. Enter the date you want to use for the monthly.

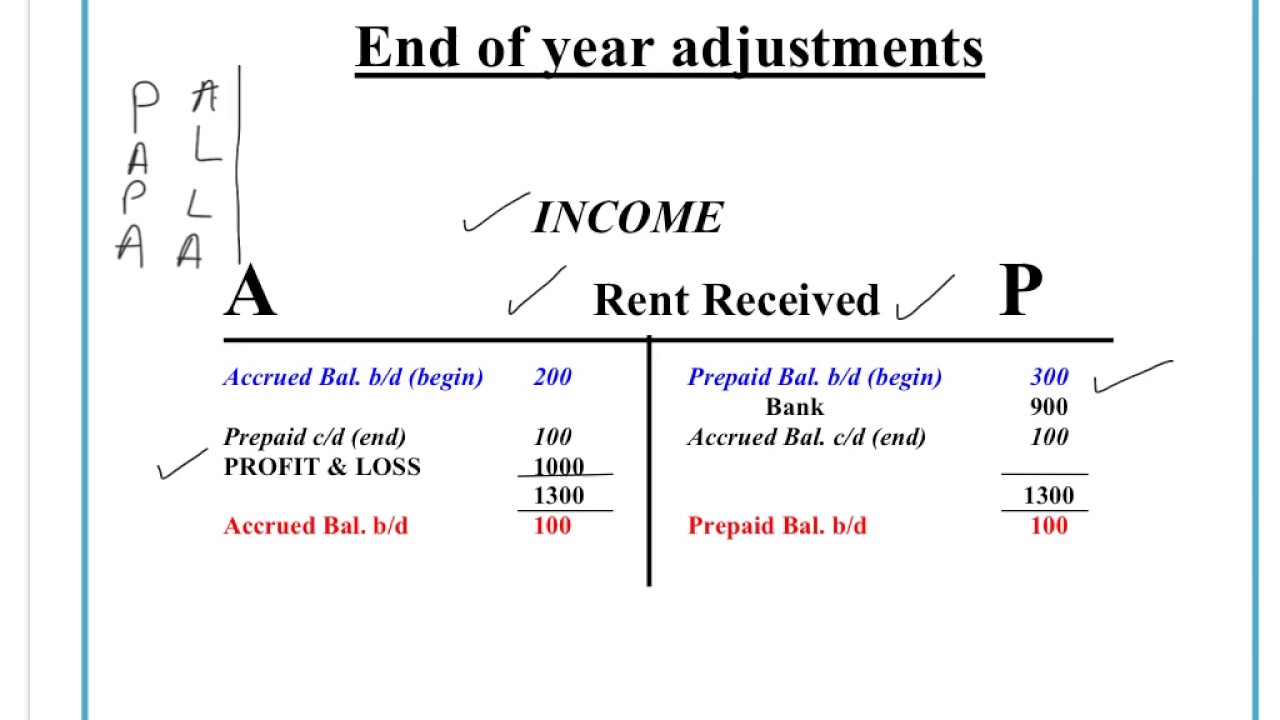

As with all double entry bookkeeping. Prepayments deal with accounting for expenditure that covers multiple accounting periods. Accruals and prepayments adjust the expense account around the bank payments so that exactly 12 months expense is recorded.

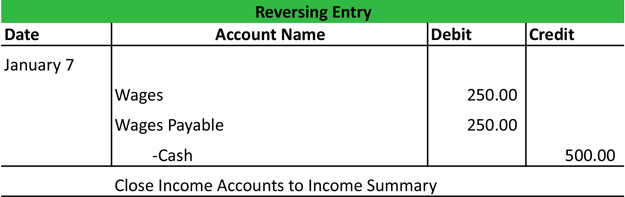

Accrual and prepayment journal entries. With amortization the prepayment will be gradually zero following the. ACCRUED EXPENSES Accrued expenses Journal Entries.

Prepayments and Accruals Adjusting Entries. During the journal entries in the accounting book of the buyer the prepayment account is debited with the payment whereas the cash account is. Prepayments Accruals.

The year-end prepayment is the 6000. This journal entry is made to account for the cash received from the prepayment as well as to recognize our obligation that we need to fulfill in the future. Likewise this journal entry of.

Debit Credit are expenses a To record the Expenses Bank incurred but unpaid. Go to Adjustments Journals New Journal and complete the following information. Accruals and prepayments give rise to current liabilities and current assets respectively in accordance with the matching principle and accrual accounting.

We can make the journal entry for customer prepayment by debiting the prepayment amount into the cash account and crediting the same amount into the unearned revenue account. The prepaid income will be recognized as income in the next accounting period to which the rental income relates. For the buyer the opposite happens.

An accrued expense or accrual is the expense that has already occurred to the company but the company has not received.

Ca Accounting Books Accruals And Prepayments Introduced Accrual Accounting Books Accounting

Reversing Entries Accounting Example Requirements Explained

Ca Accounting Books Approachs For Accrued Expenses Accounting Books Accrual Accounting Accounting

Accrued Expense Journal Entry Examples How To Record

0 Response to "Accruals and Prepayments Journal Entries"

Post a Comment